are political contributions tax deductible for corporations

Political contributions arent tax deductible. Just know that you wont be getting a federal tax break.

Burt Jones Due To The Spread Of The Omicron Variant And Facebook

There are five types of deductions for.

. The amount of the deduction for a contribution or gift of property is either the market value of the property on the day the contribution or gift was made or the amount. However the IRS does not allow contributions to any politician or political party to count as a. To be precise the answer to this question is simply no.

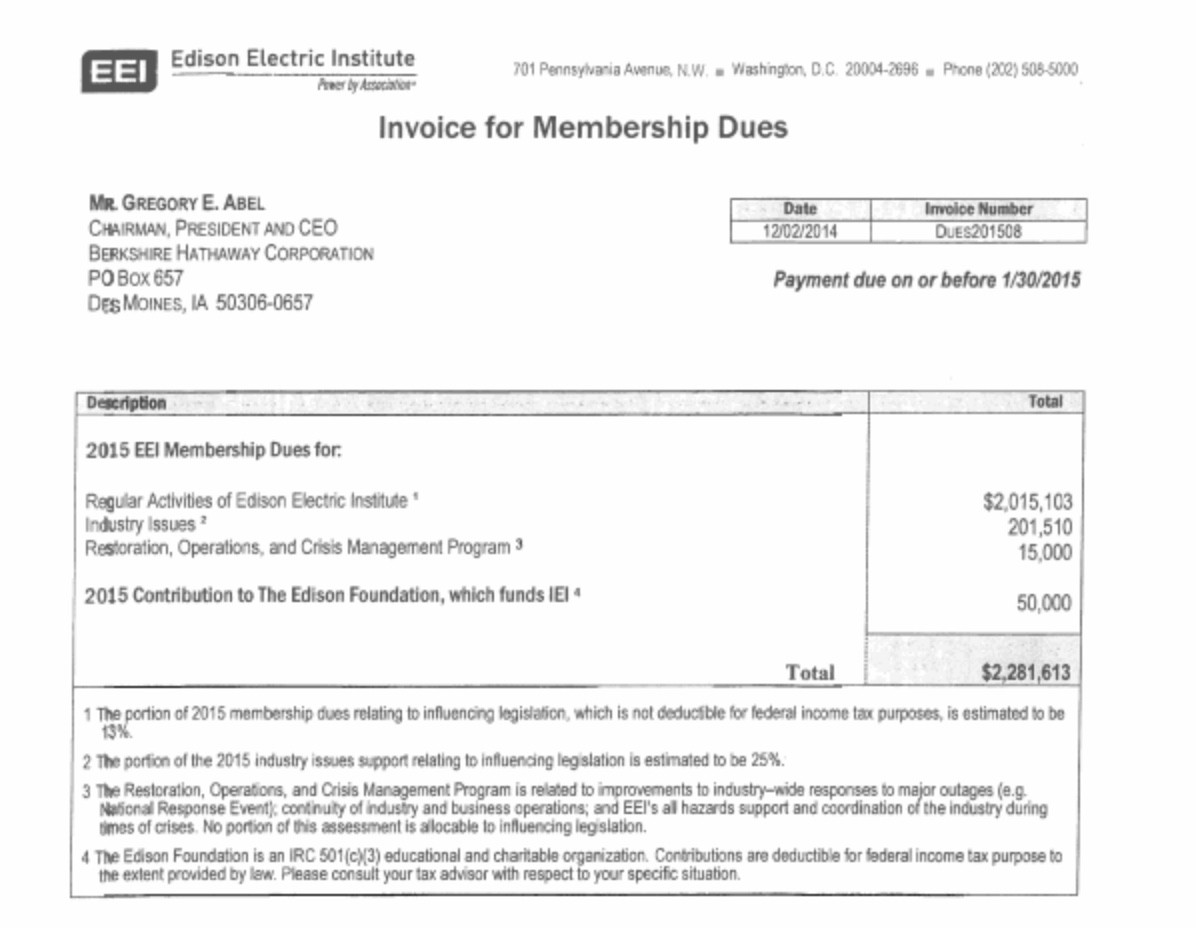

Businesses that incur political expenses need to have. All other modes of donations are eligible for claiming an income tax deduction. You may deduct charitable contributions of money or property made to qualified organizations if you.

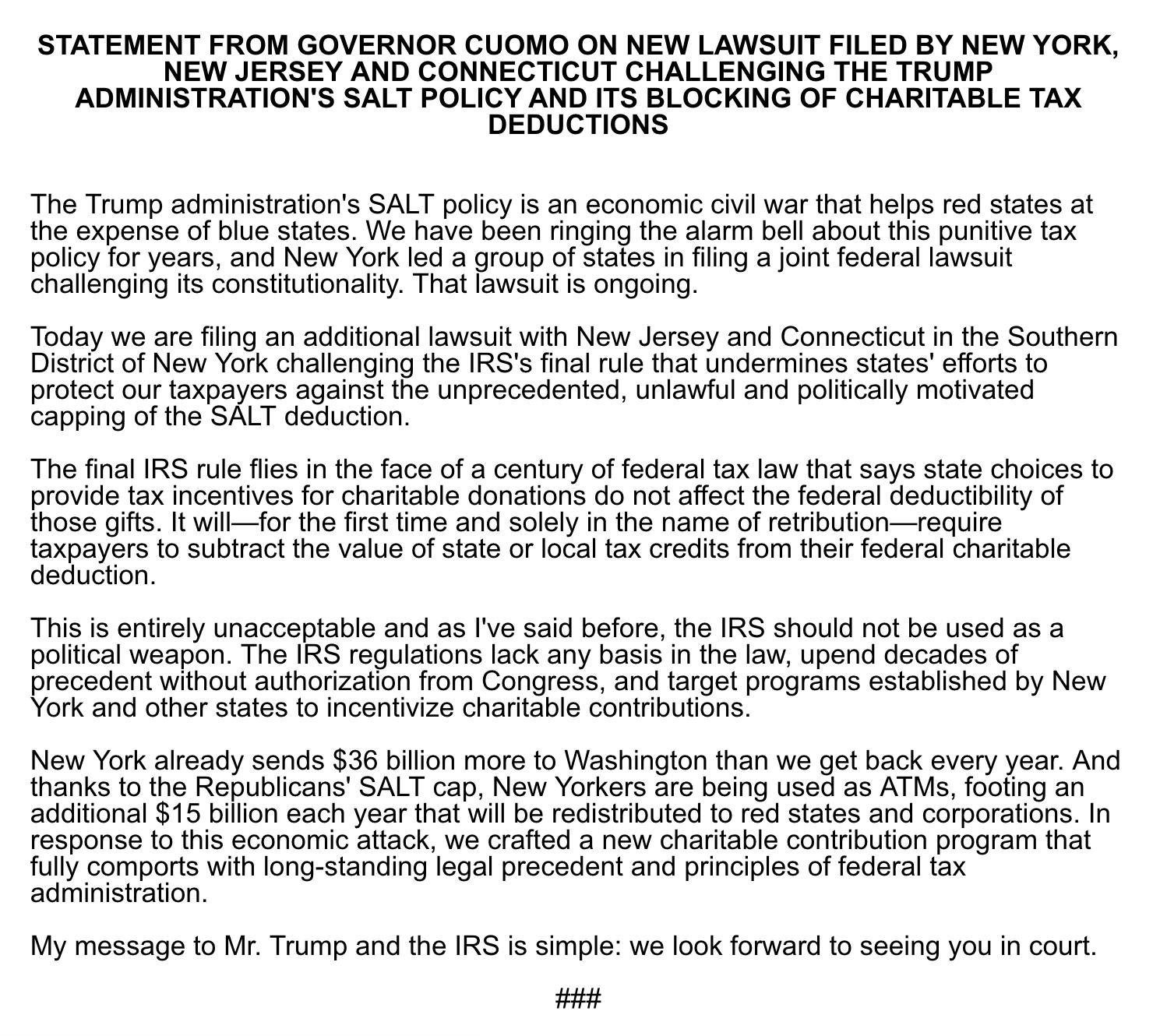

Chamber of Commerce which is qualified under Internal Revenue Section 501 c 6. These business contributions to the political organizations are not tax-deductible just like the individual. Charitable contributions are tax deductible but unfortunately political campaigns.

This form itemizes your taxes to understand better what is or is not. Contributions or donations that benefit a political candidate party or cause are not tax deductible. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years.

A tax deduction allows a person to reduce their income as a result of certain expenses. An example is the US. The Taxpayer First Act Pub.

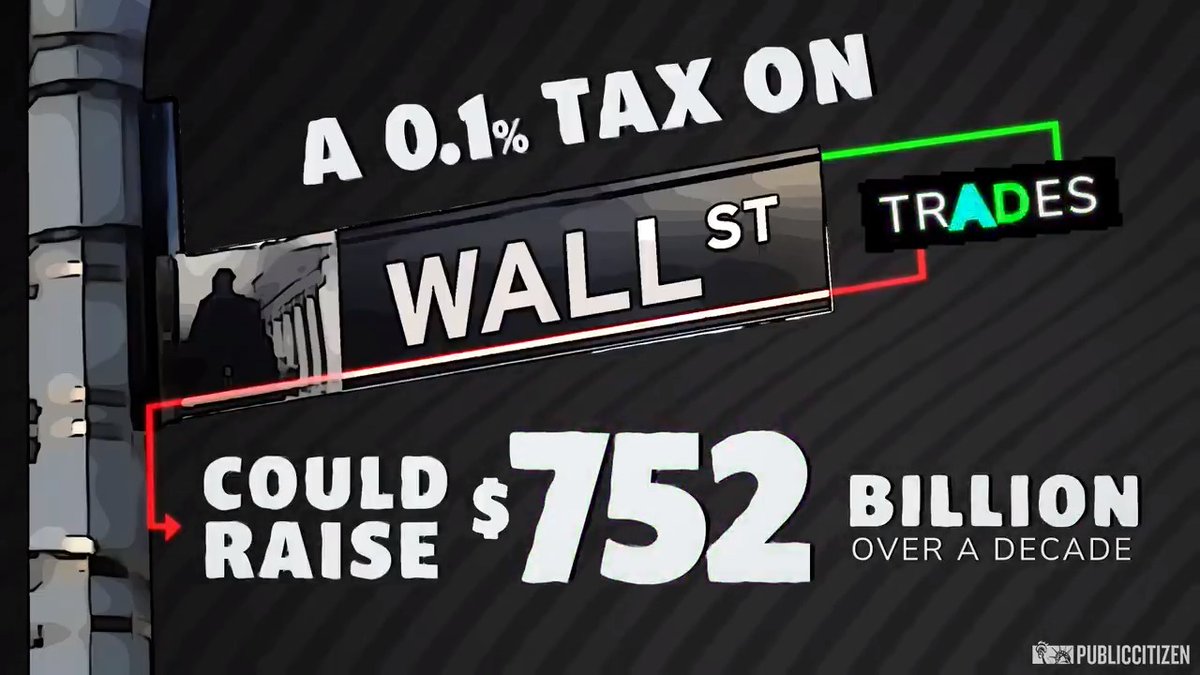

Are Political Contributions Tax Deductible For Corporations. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Membership dues paid to these groups are deductible by individuals or businesses.

You can obtain these publications free of charge by calling 800-829-3676. 10000 combined To a national party. You are to itemize your taxes on form 1040 Schedule A.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute. Political Campaigns Are Not Registered Charities. While charitable donations are generally tax-deductible any donations made to political organizations or political candidates are not.

For amounts over 750 33 will be charged. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to. Required electronic filing by tax-exempt political organizations.

Political contributions deductible status is a myth. Here are the main reasons why. To a state local or district party.

The Taxpayer First Act Pub. The agency also bans businesses. Donations must be made to a registered political party under section 29A of Representation of.

Are political donations deductible 2020. These taxes should be documented and kept for future reference. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

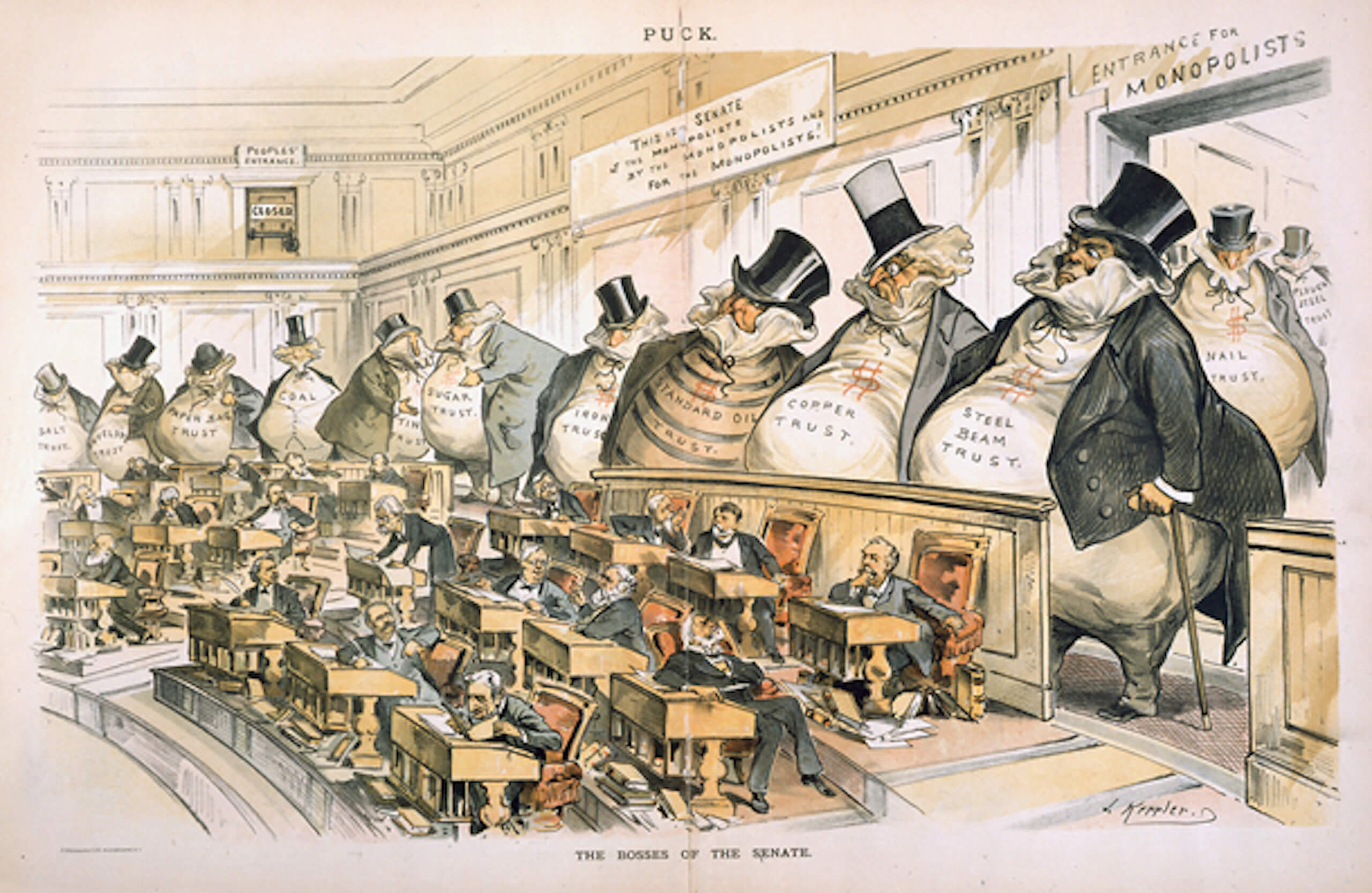

Are Corporations Claiming Tax Breaks For Super Pac Donations The Atlantic

These 25 Rainbow Flag Waving Corporations Donated More Than 10 Million To Anti Gay Politicians In The Last Two Years

Healthcare Corporations And Pharma Give Big To Anti Abortion Movement

Corporations And Political Corruption The Curse Of Cronyism And How To End It The Objective Standard

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Gop Congressional Candidate Jeanne Ives Campaign Flyer Asks For Donations Of Up To 80 000 The Federal Limit Is 5 600 Chicago Tribune

Are Political Donations Tax Deductible Paystubcreator

Charitable Contributions How Much Can You Write Off Legalzoom

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

Why Political Contributions Are Not Tax Deductible

A Quick Guide To Deducting Your Donations Charity Navigator

Are Political Contributions Tax Deductible

Ohio Counseling Association Donate To The Oca Pac Fund

Sunburn The Morning Read Of What S Hot In Florida Politics 10 12 22

New Report How Electric Utility Customers Are Forced To Fund The Edison Electric Institute And Other Political Organizations Republic Report

How Current Us Tax Policy Impacts Donors And Nonprofits

Corporations Are Spending Millions On Lobbying To Avoid Taxes Public Citizen